Article

Business methods and patentability at the EPO: challenging the notional businessperson in decision T 1392/20

At the European Patent Office (EPO), computer-implemented inventions, especially those involving business methods, face a high bar for patentability. The core requirement is that the claim must solve a technical problem using technical means. Therefore, does this mean that an invention in the filed of business methods, where the problems solved may seem inherently non-technical, cannot be patented ?

The situation is more nuanced. While business schemes themselves are not patentable, non obvious technical features that implement such schemes may be.

The most important development of the case law of the Baords of Appeal of the EPO in this field was the decision T 1463/11 ("CardinalCommerce") established a framework for distinguishing between non-technical business requirements, and technical features.

To this end, the CardinalCommerce decision introduced the concept of a notional "businessperson" (also called a "businessman" or "entrepreneur"). Like the long-established concept of a person skilled in the art, the fictitious businessperson is an abstraction intended to provide a rational approach to inventive activity.

According to the CardinalCommerce decision, the fictitious businessperson has the following characteristics:

- they possess absolutely no technical knowledge and cannot, under any circumstances, formulate any technical requirements. For example, the fictitious businessperson would not request the use of the internet or a specific number of processors;

- however, the fictitious businessperson can solve a business problem or formulate problems that go beyond preconceived notions of a commercial nature at the time of filing. The businessperson can thus formulate a problem for the person skilled in the art, in the form of a specification of conditions that does not involve any technical characteristics.

Then, the question of evidence consists in determining whether the problem formulated by the notional business person is solved by technical features that are not considered as obvious in view of the prior art.

The decision T 1392/20, dated 15 July 2025 and rendered by the Board of Appeal n° 3.5.01 of The European Patent Office, relates to an appeal against the decision of the Examining Division refusing European patent application No. 15714898.2 for lack of inventive step.

The invention concerns online payments ([0001] of the published application, and is briefly explained below:

Typically, when making online payments, customers are required to provide their payment card data to the merchant, which poses a risk of fraud. On the one hand, customers may use stolen card data, which is a risk for the merchant. On the other hand, dishonest merchants may misuse the card data, which is a risk for the customer, [0003], [0004]. To address these issues, the invention suggests configuring a user device, such as a smartphone, to function as the merchant's point-of-sale (PoS) terminal.

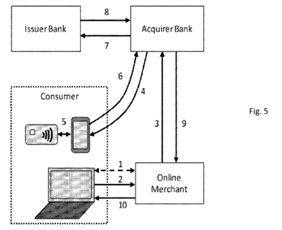

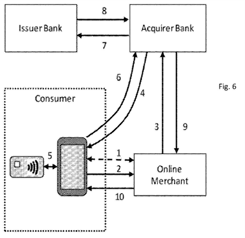

Looking at Figure 5 or 6 reproduced below, a user initiates (2) a payment transaction at a merchant's website by providing an identifier of their user device. The merchant forwards (3) the identifier to a payment service host operated for example by an acquiring bank. The host retrieves a PoS configuration profile specific to the merchant and sends (4) a corresponding PoS configuration to the user device based on routing data stored in a user device profile. The user device configures a payment application according to the received PoS configuration and reads (5) a payment card using a card reader before processing the transaction, [0051] to [0056] and [0091] to [0099].

Claim 1 of the sole request read as follows:

“A remote transaction processing system including plurality of user devices, a payment service host, and a first data store, the first data store including a user device profile for each of the plurality of user devices, each user device profile including routing data for routing communications to the respective user device;

the payment service host being arranged to receive payment requests for each of a plurality of merchants for payment for a transaction initiated at their respective merchant website,

wherein, upon receiving a payment request designating a user device for a transaction with one of the merchants, the payment service host is arranged to retrieve a Point-of-Sale, PoS, configuration profile corresponding to the merchant and retrieve the user device profile from the first data store corresponding to the designated user device, the payment service host being arranged to communicate a PoS configuration dependent on the PoS configuration profile and on payment information on the transaction including the amount to the user device in dependence on the routing data,

the user device including a secure element in which a PoS terminal application is executed and a payment card reader, the user device being arranged to receive the PoS configuration for the transaction with the merchant, configure the PoS terminal application in dependence on the PoS configuration and to communicate with a payment card via the payment card reader for payment of the transaction with the PoS terminal application to thereby act as the merchant's PoS terminal on the user device for the transaction with the merchant and complete a payment transaction, whereby the payment transaction is sent back to the payment service host.”

The differences between claim 1 and the closest prior art D4, which are common ground between the applicant, the examining division and the Board of Appeal, are the following:

- The payment service host receives a payment request identifying a specific user device for a transaction with the merchant and retrieves a corresponding user device profile, which includes routing data for communication with that device.

- The payment service host retrieves a PoS configuration profile associated with the merchant and sends a corresponding PoS configuration to the user device based on the routing data.

- The user device configures a PoS terminal application within a secure element based on the received PoS configuration, enabling it to act as the merchant's PoS terminal and complete the payment transaction by communicating directly with the payment service host.

The examining division considered that claim 1 was not inventive in view of the document D4, because the PoS configuration profile to represent a set of business rules or preferences defined by the merchant, and deploying such preferences to the user device as in features 1) to 3) was a straightforward implementation of a non-technical business requirement on a generally known payment system architecture.

The Board of Appeal took a different view, that is expressed in the point 4.5 of the decision. In line with the Cardinal Commerce approach, the Board held that:

- the notional business person could provide the abstract goal of avoiding the transmission of card data to the merchant ;

- features 1) to 3) are technical, and define a technical solution to achieve the abstract goal submitted by the business person.

More specifically, the Board considered that the steps 1) to 3) involve modifying the existing system infrastructure, including how the user device is configured and integrated into the payment flow. Such changes require technical knowledge of the system architecture and fall within the expertise of the technically skilled person - not the business person, who may define the desired business objective but lacks the competence to specify the structural and functional changes needed to implement it.

The features 1) to 3) being considered to contribute to the technical character, the Board considered that they provide an alternative online transaction system in which the user's payment card data are not shared with the merchant. The Board further held that there was no apparent reason in view of the other cited documents, except in hindsight, to change the user device's functionality so that it acts as a PoS terminal directly completing the transaction.

The refusal of the examining division was thus overturned, and claim 1 considered inventive by the Board.

This decision illustrates the “Cardinal Commerce” approach of the Boards of Appeal of the EPO with regards to mixed invention relative to Business Methods.

As in some other preceding cases such as for example the decision Cardinal Commerce T1463/11 itself, or the decision T1749/14, a decision of the examining division refusing a European patent application that would allegedly relate to a non-patentable business scheme was overturned thanks to a precise separation of the features that would relate to the definition of a business requirement, and technical features.

This decision thus reminds applicants that inventions relative to business methods can be allowed by the EPO, if they relate to a technical implementation of a business scheme, that is not suggested by the prior art.